(Average read time: 3 minutes)

How do you create $156,428 in new wealth? It’s so simple that I hope it blows your mind. All you need is a little patience.

It started last night. I was paying my bills and there it was – my credit card.

I’ve been in debt-reduction mode for a while, but that can go slower than most people would like. This specific credit card has a $4,000 balance and a 20.49% interest rate. Yikes! I can’t even remember what I bought – probably tacos and Starbucks. Oh yeah, and the Playa Del Carmen trip last year. Good times!

$4,000 balance x 20.49% rate = $820 per year or $68 per month in interest.

Here comes the fun part…

I decided to finally pay that credit card!

That alone is enough to get excited about, but things gets even better…

I’m going to take that $68 per month and invest it in my IRA (Investment Retirement Account) which is free to setup at many stock brokerage places. I use TD Ameritrade. I’m not endorsing them, that’s just who I use.

The credit card being paid off is important, but that’s just the beginning.

The power of saving and investing is what will change your life.

Here’s the part that should blow your mind…

I’m going to invest the $68 in a simple index fund that essentially performs similar to the S&P 500 (A major US stock index).

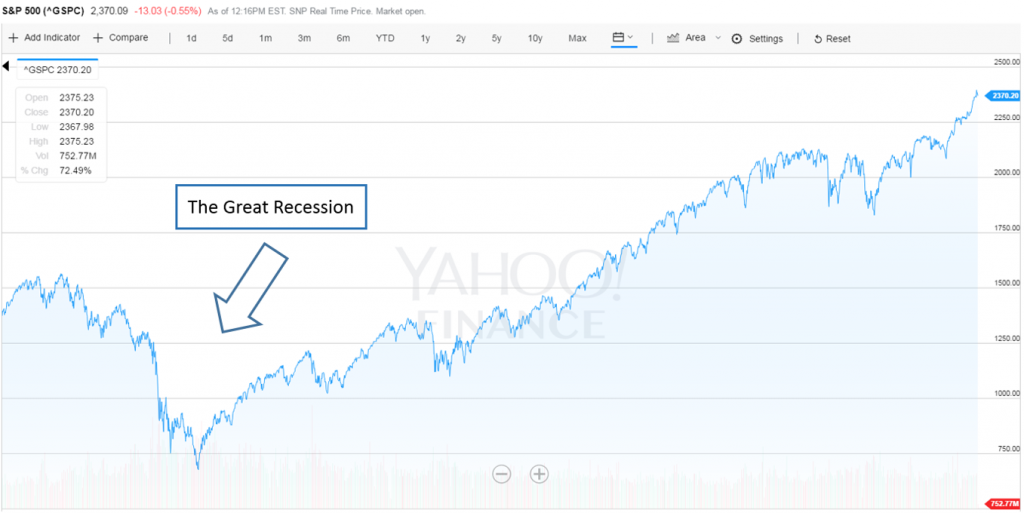

The S&P 500 grows about 10% per year, on average. Some people argue this is not realistic because times have changed.

Fine. In the last 10 years (chart below), the S&P has grown 73.4%. That’s approximately 7% per year. This period includes the housing crash in 2007-08 and the great recession that followed. It still did 7% per year! In all fairness, some years it was down 20% and other years it was up 30%, but a 7% average is not terrible.

Let’s meet in the middle. Say we can realistically earn 8.5% per year. What does that mean for the $68 per month?

Total mind meltdown coming up…

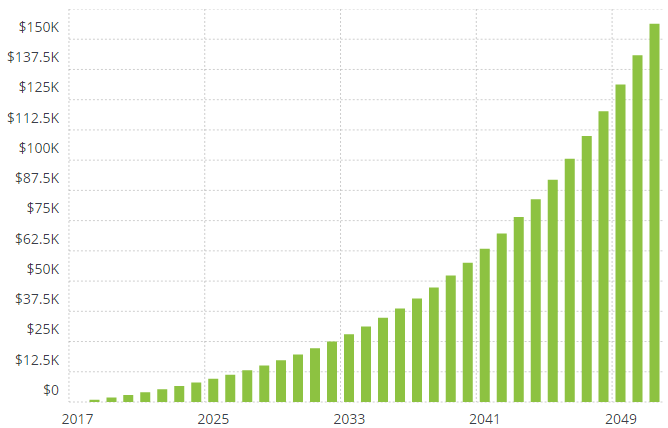

Invest $68 per month, averaging 8.5% growth per year, and let’s say I don’t touch the money until I retire at age 65 – I’m 31 now.

At age 65, the simple act of paying off this one credit card and investing that money instead of giving it to the bank results in:

$156,428

That is the power of Time Value of Money and Compound Interest. If you take one bit of information away from this post, let it be the terms I just mentioned. Time Value of Money and Compound Interest. This is how rich people get even richer.

Let’s take it one step further…

If your mind isn’t jumping for joy yet, what I’m about to tell you will definitely get your juices flowing.

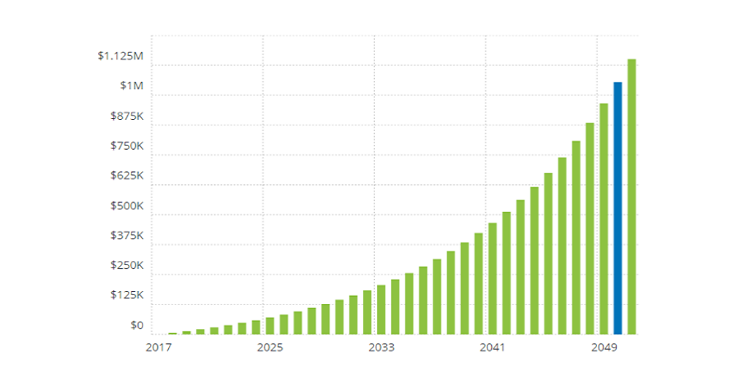

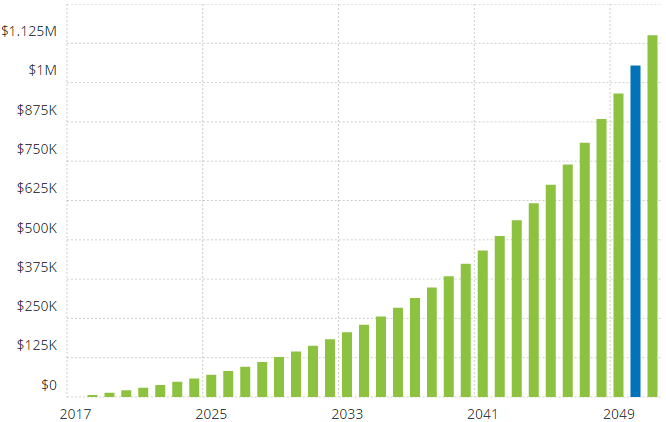

Forget about the $68. Let’s say we can find a way to invest $500 per month. Using the same 8.5% growth per year, at age 65 you can have:

$1,150,209

You read that right. You see that blue bar in the chart? That’s the year your account would reach ONE MILLION DOLLARS.

How awesome will it be to see that extra comma in your retirement account?

It’s not too late. Time is your best friend if you start now.

Grab the scissors and do some plastic surgery on that Amex.

It starts with $68.

RELATED ARTICLES: